Sep Ira 2024 Limit. The amount of compensation you can use to calculate the 25% limit is limited to $330,000 in 2023 and $345,000 in 2024. 2024 sep ira contribution limits.

Employers can contribute the lesser of 25% of the employee’s annual compensation or $69,000 toward a sep ira in 2024. For 2024, the maximum an employer can contribute to a sep ira is the lesser of $69,000 or 25% of the employee’s compensation.

can i contribute to an ira and a sep ira in the same year Choosing, If you have a workplace 401(k) and a sep ira, you can contribute to both of these accounts. That limit jumps to $345,000 in 2024 and is adjusted annually by the irs.

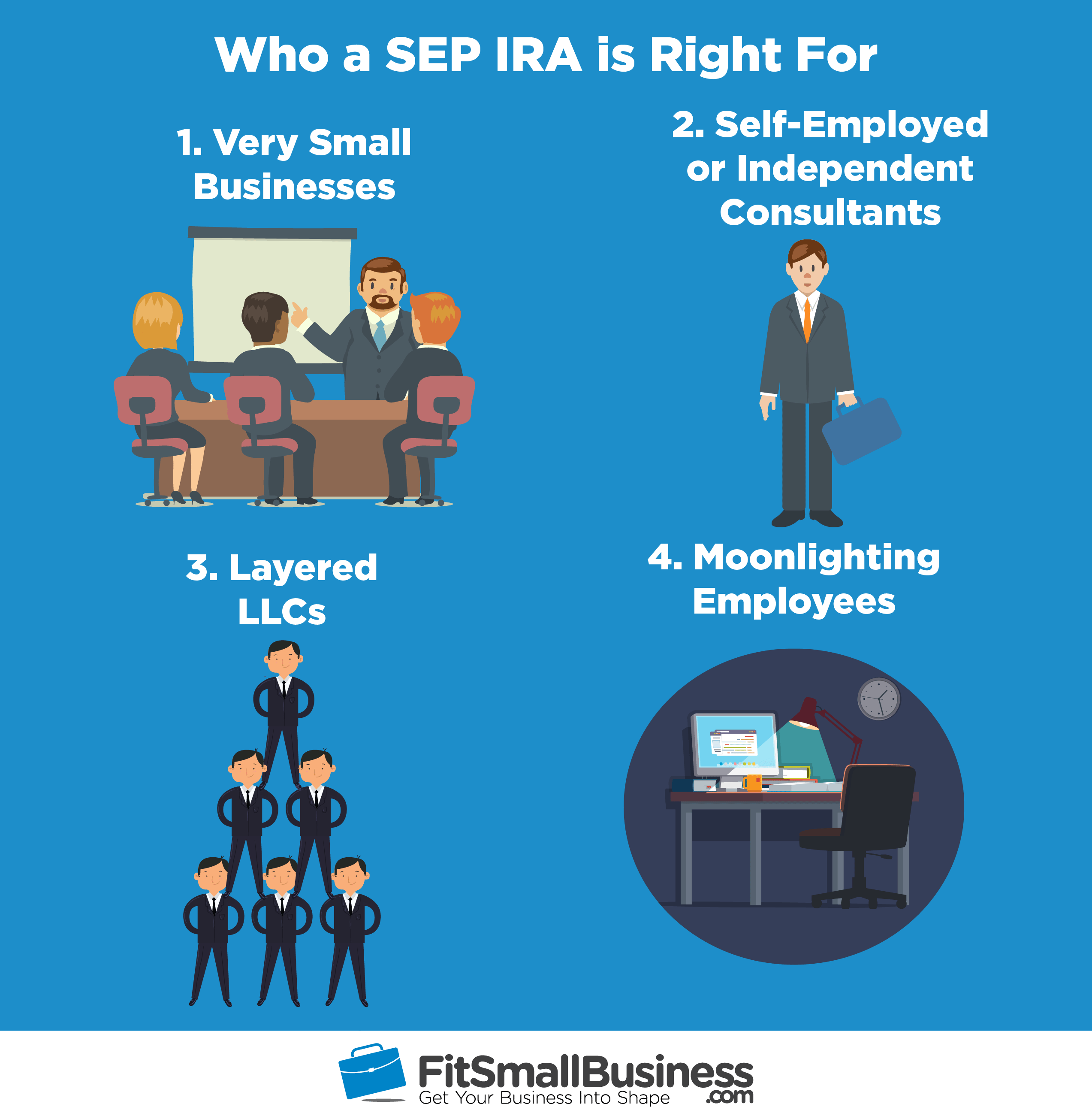

SEP IRA (SEP Retirement Plan), This paper aims to dissect the fundamental components of sep ira, its contribution rules, the forecasted limits for 2024, taxation implications, and its comparison with other ira. Sep ira contribution limits are higher than most options, which a max contribution limit of up to $66,000 for 2023 and $61,000 for 2022.

simple ira withdrawal rules firsttime home buyer Choosing Your Gold IRA, $66,000 in 2023 and $69,000 in 2024 Employer contributions need to be made by the due date, including extensions.

Fica Salary Limit 2024 Amye Kellen, If you have a workplace 401(k) and a sep ira, you can contribute to both of these accounts. That’s over 10x higher than.

can i contribute to a roth ira and a sep ira in the same year, The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older. The amount of compensation you can use to calculate the 25% limit is limited to $330,000 in 2023 and $345,000 in 2024.

IRA Contribution and Limits for 2023 and 2024 Skloff Financial, If you have a workplace 401(k) and a sep ira, you can contribute to both of these accounts. Unfortunately, since a sep ira is a type of traditional ira, you can’t combine a sep ira with a roth ira.

SEP IRA Deadlines, & Rules, Contribution Limits Small Business Growth, Sep ira contribution limits are higher than most options, which a max contribution limit of up to $66,000 for 2023 and $61,000 for 2022. For 2023, that limit is $330,000, an increase from $305,000 in 2022.

Can You Exclude Employees From a SEP IRA?, Employers can contribute up to 25% of their compensation up to $66,000 for 2023 and $69,000 for 2024. Traditional ira and roth ira contribution limits.

Ira Contribution Limit For 2024 Dix Vickie, That limit jumps to $345,000 in 2024 and is adjusted annually by the irs. Unfortunately, since a sep ira is a type of traditional ira, you can’t combine a sep ira with a roth ira.

2022 contribution limit sep ira Inflation Protection, Americans who are 50 or older can contribute an additional $1,000 in. $66,000 in 2023 and $69,000 in 2024

Employers can contribute up to 25% of their compensation up to $66,000 for 2023 and $69,000 for 2024.

What Is Business Mileage Rate For 2024. This makes calculating business mileage fairly simple. 17 rows 2023 mileage rates. The…

Minimumloon 2024 Per Uur Parttime. Sinds 1 januari 2024 is de werkgever volgens de wet verplicht om werknemers per uur…

Us Open 2024 Earnings. Open championship at pinehurst resort & c.c. The official site of the 2023 us open tennis…